is a new roof tax deductible in 2019

The cost of a new roof is an expense investment that most property owners hope they can get some relief from at tax time. Unfortunately you cannot deduct the cost of a new roof.

Home Buying Tax Deductions What S Tax Deductible Buying A House Tax Deductions Real Estate Estate Tax

Generally speaking as with any major home improvement like replacing your HVAC system or making an addition roof replacement cannot be deducted in the year that.

. Dear Patty Yes you may qualify for the credit and you are going to need to look at Form 5695 residential energy credits. August 28 2019 by Howard Rittenberg Homeowners are seldom able to write off their new roofs on their taxes. If you get a new roof the section 179 deduction allows you to deduct the cost of it.

However the IRS does not allow full deductions for. September 3 2019 by Shannon Morton One of the most frequently asked questions about roof replacement is whether the project is tax-deductible or not. The type of credit you may qualify for is listed in Part II.

Installing a new roof is considered a home improve and home improvement costs are not. If you are replacing or adding a new roof to your home you could qualify for an energy-efficient home improvement tax credit for as much as 10 percent of the cost not counting installation costs. All these credits were valid through the 2016 tax.

The entire 1200 is deductible. If you reroof a rental house. Tax Credit Amount.

For most homeowners the basis for your home is the price you paid for the home or the cost to build your home. The roof may qualify for an energy saving improvement credit if it meets certain energy saving. Is there a tax credit for a new roof in 2019.

Thats why roofing contractors often advise homeowners to wait. If you are replacing or adding on to your existing roof you. In 2018 2019 2020 and 2021 an individual may claim a credit for 1 10 of the cost of qualified energy efficiency improvements and 2 the amount of the residential energy.

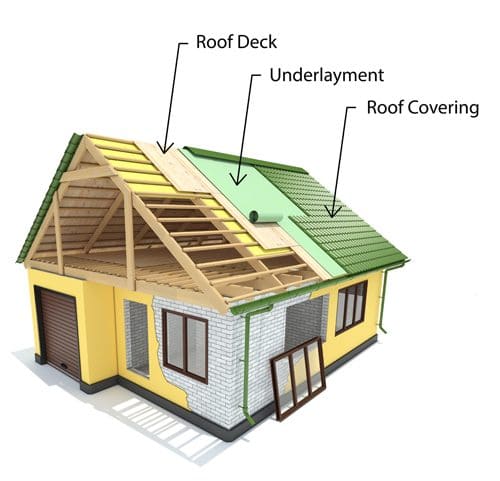

Unfortunately you cannot deduct the cost of a new roof. However home improvement costs can increase the basis of your property. There are two types of new roofs that will qualify for a tax credit.

It often requires advance planning and budgeting. 10 of the cost up to 500 NOT INCLUDING INSTALLATION Requirements. Installing a new roof is considered a home improvement and home improvement costs are not deductible.

If you installed an energy efficient new roof in the past two years you may qualify for an energy tax credit from the federal government. Major home improvements have significant costs so loans can be very helpful. 1 Metal roofing that is coated with Energy Star certified paint or pigment specifically designed to reduce heat.

Homeowners can receive 10 of the cost of their new. Installing a new roof is considered a home improve and home improvement costs are not deductible. Metal roofs with appropriate pigmented coatings and asphalt roofs with.

Heres how to add your roof tax deduction to your tax return and the requirements to receive a roof tax credit. Click to see full answer. However the irs does not allow full deductions for this type of expense when it is incurred.

However changes in the tax law allowing owners to expense a new commercial roof in a single year might make installing a. April 15 2019 by Jack Cottrell. For most people the state and local income taxes paid usually gives them the higher deduction but for others the sales tax deduction may give them a.

Under the law you can get tax deductions from the interest of. Likewise people ask is there tax on a new roof. If you are replacing or adding on to your existing roof you may qualify for an energy-efficient home improvement tax credit through Energy Star.

If you pay for a new roof this year dont expect to write it off on your taxes. These expenses for your main home are not deducible on your tax return. Other than a few special cases you cant deduct home improvements on your 1040.

These credits apply to improvements like solar panels wind turbines fuel cells geothermal heat pumps and solar-powered water heaters. Unfortunately you cannot deduct the cost of a new roof.

Guide To Expensing Roofs Expense V Capitalization Section 179 D

Florida Raises The Roof On Skyrocketing Home Insurance Costs Forbes Advisor

Federal Tax Credits Can Help Sell Roofs Building Knowledge Certainteed S Official Blog

Are Roof Repairs Tax Deductible B M Roofing Colorado

Can I Claim The Federal Solar Tax Credit For Roof Replacement Costs Westfall Roofing Tampa Sarasota

Can I Deduct A New Roof On My Taxes

Can Roof Replacement Be Tax Deductible Here Are The Ways

7 Home Improvement Tax Deductions Infographic Video Video Tax Deductions Tax Write Offs Deduction

Are Roof Repairs Tax Deductible The Roof Doctor

Irs Tax Forms Infographic Tax Relief Center Video Video Small Business Tax Deductions Business Tax Deductions Small Business Tax

Roofing Basics The Tax Credits Explained For Replacing A Roof

179 Tax Deduction For Commercial Roofing Projects Advanced Roofing Inc

Are Metal Roofs Tax Deductible

Is Roof Replacement Tax Deductible Residential Roofing Depot

Roofing Basics The Tax Credits Explained For Replacing A Roof

Keep Precise Records Of Your Rental Income Business With Our Printable Rental Worksheet Bundle The Printab Rental Income Income Tax Preparation Tax Printables

Deducting Cost Of A New Roof H R Block

Is Your Commercial Roof Tax Deductible Sentry Roofing

Can You Claim A Tax Deduction On Your New Roof Ken Morton Sons Llc